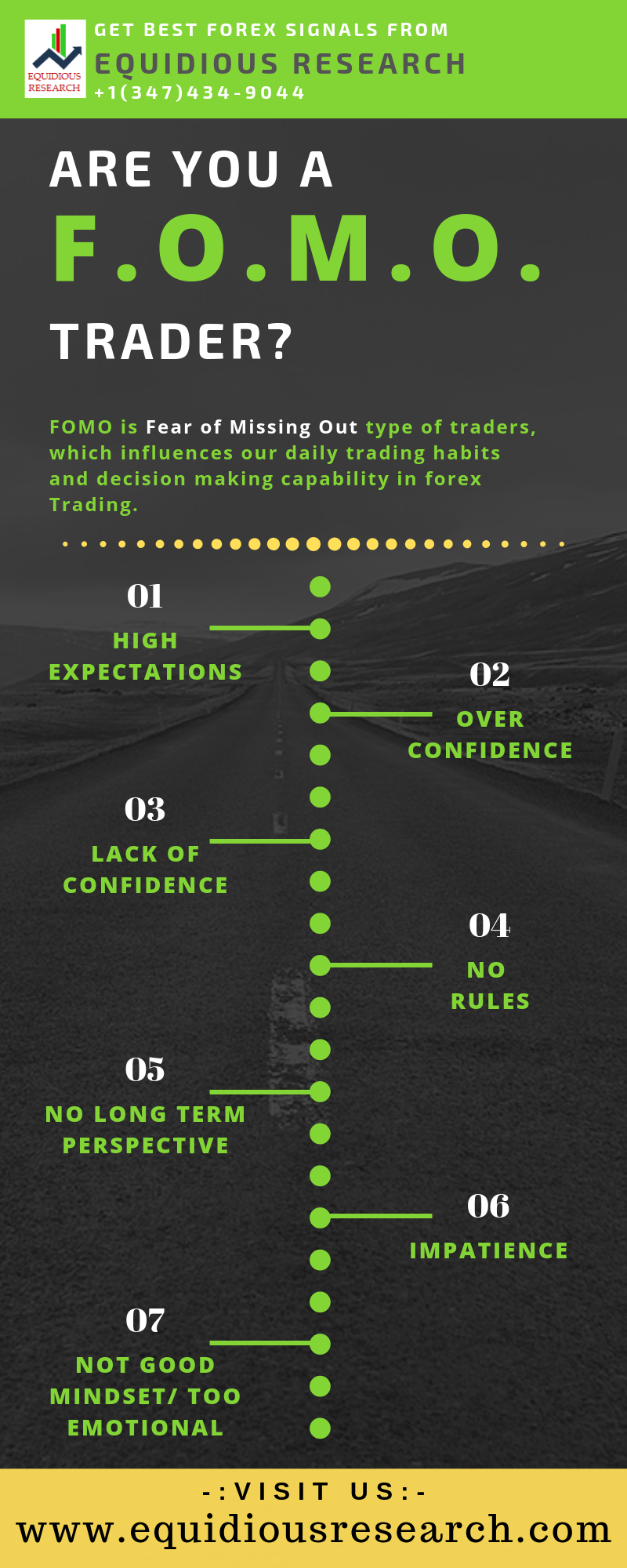

Money Management in forex is one of the important factor for consistent profit. Due to its volatility, the Forex market is inherently risky. Money management in Forex is therefore a non-negotiable success factor for both beginners and experienced traders alike. Successful traders in the long run about the single most important factor in trading, and the majority of them will tell it’s a strict way of managing your money and risk. Even the best strategy in the world won’t be of much help if you don’t take care about your risk per trade, reward-to-risk ratios, don’t use stop-loss orders or trade too aggressively. Money Management in Forex

Courtesy: Equidious forex signals

RISK PER TRADE

Risk per trade is the amount of your trading account that you’re ready to risk on a single trade. It’s a key aspect of prudent money management that prevents you from blowing your account. Many money management techniques state that the upper limit of your risk per trade should be 2% of your trading account, or even less if you’re a beginner in the markets.

NEVER GO WITHOUT SL

A stop-loss order is the only guarantee that you won’t lose a substantial amount of money on a single trade. Although certain market conditions can lead to your stop-loss order not being executed at the set price, most of the time they work just well to prevent losing your entire account on a few trades.

REWARD TO RISK RATIO

Placing inappropriate take-profit levels can be as damaging to your trading results as placing inappropriate stop levels, as you won’t be able to maximize the profit potential of your trade setup.Your take-profit level also determines the reward-to-risk ratio of your trade, which simply represents the amount of your risk relative to the potential profit of the trade. While R/R ratios of 1:1 mean that you’re risking the same amount as your potential gain, trades with R/R ratios of 2:1 or 3:1 have double or triple the amount of potential gain relative to the risk.

BETTER LEVERAGE

Leverage offers the opportunity to magnify profits made from the risk capital you have available, but it also increases the potential for risk. It’s a useful tool, but it is very important to understand the size of your overall exposure. Your broker may give you some leverage on your account to enable you to trade for bigger profits. However, you need to be careful when using this facility.

CONTROL YOUR MINDSET

If you do your analysis right, have confidence in your entry and exit levels and let the market determine if you were right or wrong.Having a strict and written trading plan that contains not only your trading strategy, but also the way you manage money and risk, can help you to avoid emotional trading.

AVOID AGGRESSIVE TRADING

Trading too aggressively is perhaps the biggest mistake new traders make. If a small sequence of losses would be enough to eradicate most of your risk capital, it suggests that each trade has too much risk. A good way to aim for the correct level of risk is to adjust your position size to reflect the volatility of the pair you are trading. But remember that a more volatile currency demands a smaller position compared to a less volatile pair.

Follow the best signal provider which works more on Risk Analysis, Money Management and expert analysis. Try Equidious Forex Signals for best forex and comex signals.

For the Best Forex Signal| Accurate Account Management| Profitable Comex Signals, Try Equidious Forex Signals. We have a team of best and well experienced Research Analysts.

Happy Trading!