De-globalization is the idea which picked up energy after BREXIT. Trump’s choice to force duties of 25% and 10% on steel and aluminum import will add to de-globalization talk. US, under Trump, has hauled out of Trans Pacific Agreement and began arranging NAFTA. Worldwide exchange has begun redirecting from way of multilateral exchange settlement to plurilateral exchange agreement.

Forcing of levy by Trump, in bearing of US first arrangement, is probably going to harmed US and different economies associated with related exchange with Uncle Sam. Canada, Brazil, EU, China, Russia, UAE are the significant nations who are enjoyed exchange of both the wares. Car and development industry expends near 65-70% of US steel request. As per an article distributed in Reuters, a normal US vehicle devours 1-1.2 ton of steel .US steel generation cost is in the middle of $825-875 for each ton. In the event that we consider, imported steel cost in the middle of $650-750, 25% import levy may add $150-180 to the vehicle’s expense. Aside from steel, aluminum is additionally utilized in car which is likewise likely add to creation cost. US imports near 7 million tons of Aluminum as neighborhood creation isn’t equipped for providing to US request. Canada is the significant provider of both Aluminum and steel to US, which is as of now shaken by NAFTA arrangements. Retaliatory activities have been cautioned by EU, China and Canada. EU has arranged rundown of items, $3.5 billion worth of exchange, on which 25% import obligation will be mixed, in the event that Trump advance with the arrangement.

US shoppers are probably going to get affected as buyer surplus will be redirected to government’s assessment kitty since it is exceedingly far-fetched that trading economies will lessen rate so as to be focused. US ventures like vehicle, aeronautics, development, aluminum bundling will confront the brunt of expanded crude material expense and effect on deals. US is as of now loaded by twin deficiency and require remote money to cross over any barrier. Corporate tax break will liable to include $300 billion shortage over next 2 years. China and Japan holds more than 50 % of outside capital investment in US treasury. Treasury war is one of the retaliatory response which influenced nations can pick. This situation of dumping US bonds is profoundly impossible as it will in the end hurt treasury holding nations remaining bond portfolio .

Greater expense of definite merchandise will hurt investment funds of US buyers. US steel and aluminum industry are progressively capital concentrated. So machine will add benefit to makes bottomline and business won’t be profited much. Work in industry ,reliant on wares as crude material ,will be affected in the event that US purchasers don’t free tote to spend additional greenbacks. Inflationary weight will be checked whether US buyers keep obtaining at same pace. Treasury yields can ascend because of inflationary weight, quicker pace of financing cost climb and affected nations falling back on treasury war. In last 2 occurrences of tax climb in 1995 and 2002, greenback saw deterioration in esteem, however it was joined by different reasons moreover. Last couple of lodging and development information were appearing of first time purchasers because of more expensive rates of single family home which ascended by over 5% in 2017. 30 years home loan rate is drifting @4.3% which is close to multi year high. Expanded expense of development and weight on treasury yield (thusly affecting home loan yield) will build danger of droop in lodging area.

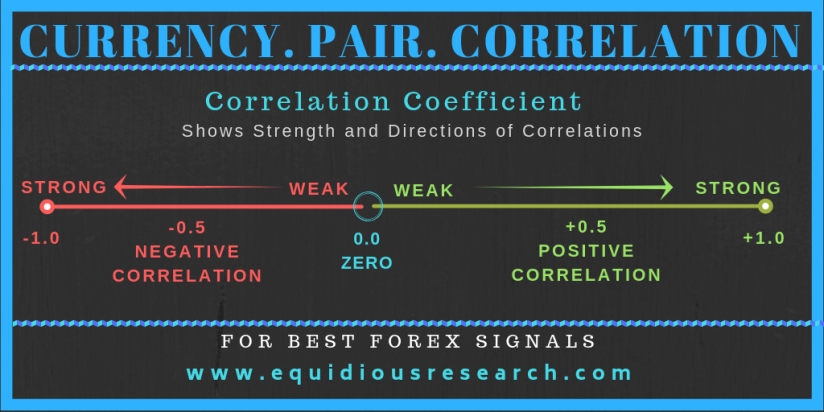

USD ought to at first devalue against worldwide monetary forms, if Trump proceeds with arranged tax climb. Progressively, difference in central banks policy will make US treasury increasingly pertinent to speculators looking for generally safe fair return venture and help greenback to win lost ground.

For Best Forex and Comex Signals please visit www.equidiousresearch.com