What is Currency Correlation?

Currency correlation depicts an extent to which two currency pairs have moved in same, opposite, or totally random directions over a period of time.

Thought Process:

Why a certain currency pair rises, another currency pair falls?

Why same currency pair falls, another currency pair seems to copy it and falls also?

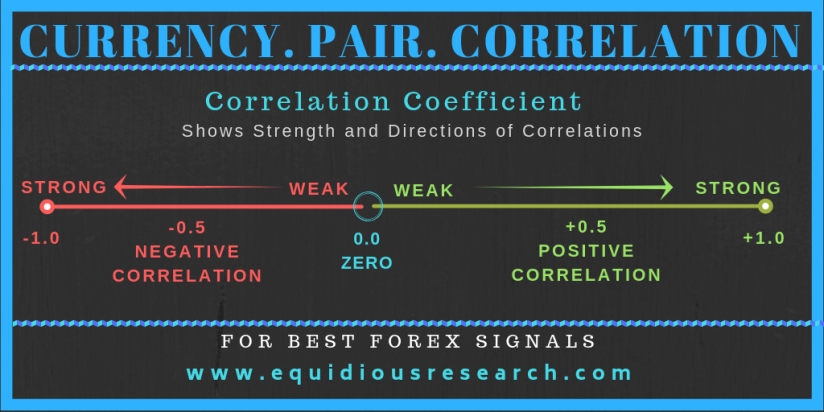

This is because of correlations between currencies. Correlation is the numerical measure of the relationship between two variables. The range of the correlation coefficient is between -1 and +1.

Positive Correlations: A correlation of +1 denotes that two currency pairs will flow in the same direction.

For Example: Correlation between EUR/USD and GBP/USD is an epitome as if EUR/USD rises then GBP/USD is moving the same direction.

Negative Correlations: A correlation of -1 indicates that two currency pairs will move in the contradictory direction 100% of the time.

For Example: Correlation between EUR/USD and USD/CHF is an epitome of negative correlation, if EUR/USD rises, then USD/CHF falls.

Zero Correlation: The correlation of zero denotes that the relationship between the currency pair is completely arbitrary.

Currency correlation is strongly connected with risk management, and can help you to better understand the market when trading.

Some of the highly correlated currency pairs are:

Positive Correlations:

EUR/USD and GBP/USD (+ 0.89)

EUR/USD and AUD/USD (+ 0.81)

EUR/USD and EUR/CHF (+ 0.93)

AUD/USD and Gold (+ 0.75)

Negative Correlations:

EUR/USD and USD/CHF (- 0.85)

USD/CAD and AUD/USD (- 0.88)

AUD/NZD and NZD/SGD (- 0.78)

USD/JPY and Gold (- 0.78)

Join 300,000+ traders who stay ahead of the market, submit your details with us by filling our CONTACT FORM.

For the Best Forex Signal| Accurate Stock Signal| Profitable Comex Signals, Try Equidious Research Services. We have a team of best and well experienced Research Analysts.

Enjoy Trading!