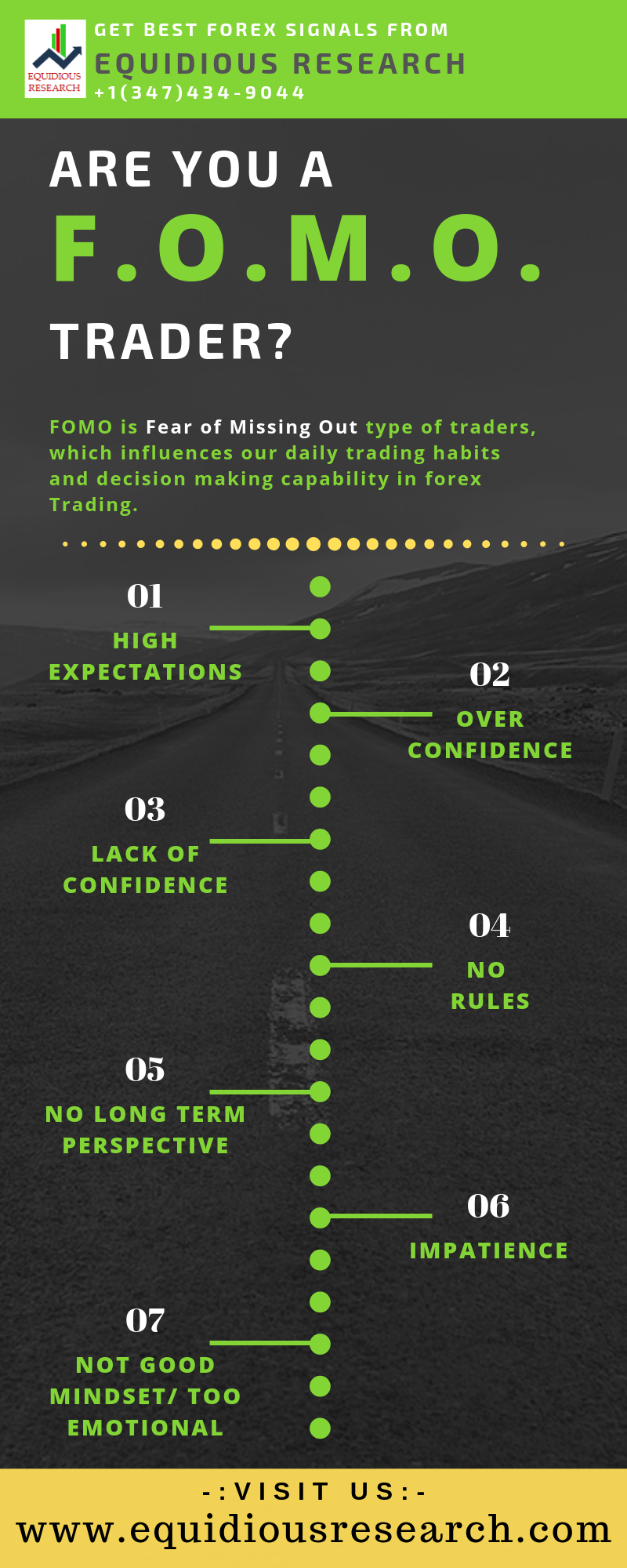

FOMO is Fear of Missing Out type of traders, which influences our daily trading habits and decision making capability in Forex Trading.

There are following causes which leads FOMO Traders:

High Expectations

FOMO Traders thanks that one needs to double the account by next month and you are missing out if you do not make a lot of money as soon as possible. This leads to higher risk and large position sizes. One wrong trade and you will regret of choosing wrong position sizing and trade.

Over Confidence

When you come from a winning streak and feel invincible and then take random trades or too large positions because you think we can “feel” what the market is going to do.

Lack of Confidence

After a few losing trades, many traders will try to play catch up and then enter random trades just to get into the market and hopefully somehow generate a profit.

No Rules

When you do not have a system or rules, to begin with, then FOMO is your default mode, always jumping in and out of the market, not really knowing what you are doing.

Lack of Long Term Perspective

When you do not understand that there will be hundreds and thousands of new trades waiting for you. Many amateurs put way too muchimportancet on one trade alone and want to force this trade to win whatever it takes.

Impatience

When you do not want to wait for the setup and just want to get into a trade because you fear that the price might run away.

Wrong Mindset or Too Emotional

Every Forex trader wants to improve their forex trading success. Successful trading is difficult and building the correct attitudes and beliefs is the way to develop the habits and skills necessary for profitable trading. Without a profitable and successful trading mindset, you will be swimming upstream against your emotions/fears, thoughts, and unconscious habits which undermine your success.

Join 300,000+ traders who stay ahead of the market, submit your details with us by filling our CONTACT FORM.

For the Best Forex Signal| Accurate Stock Signal| Profitable Comex Signals, Try Equidious Research Services. We have a team of best and well experienced Research Analysts.

Trading is an art of making handsome amount.

Enjoy Trading!